54+ how much of your monthly income should go to mortgage

Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest. Some financial experts recommend other percentage models like the 3545 model.

What Percentage Of Income Should Go To Mortgage Morty

Comparisons Trusted by 55000000.

. Most home loans require a down payment of at least 3. Ad Compare Mortgage Options Calculate Payments. This rule states you should limit your.

Web Lenders use your debt-to-income ratio DTI as a measure of affordability. Of course if you are able to spend less than. Web Front-end only includes your housing payment.

One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule. Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. Thats a mortgage between 120000 and.

Ad 5 Best House Loan Lenders Compared Reviewed. Web The amount of money you spend upfront to purchase a home. This rule says that you should not.

Keep your mortgage payment at 28 of your gross monthly income or lower. Web For example some experts say you should spend no more than 2x to 25x your gross annual income on a mortgage so if you earn 60000 per year the. The 28 rule isnt universal.

The current rate for a 30-year fixed-rate mortgage is 650 up by 018 percentage points from a week ago. Keep your total monthly debts including your mortgage. Web Aim to keep your mortgage payment at or below 28 of your pretax monthly income.

So taking into account homeowners insurance and property taxes. Web This means that if your household brings in 4000 a month your mortgage payments should be no more than 1000. A 20 down payment is ideal to lower your monthly.

Ideally that means your monthly. Web 28 of Gross Income. Ad Calculate Your Payment with 0 Down.

Web The calculator works immediately as you slide or input your gross monthly income monthly debts loan terms interest rate and down payment. Ad Enter Your Mortgage Details Calculate Your Monthly Payment and Contact Lenders. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best.

Get Instantly Matched With Your Ideal Mortgage Loan Lender. Web The 3545 Model. Best Mortgage Lenders in Pennsylvania.

A more conservative rule of thumb is to limit your monthly mortgage payment to 25 of your after-tax income ie what you see in your. Save Time Money. This rule says you.

Web Some say to limit your monthly mortgage payment to 28 of your gross income while others use the 3545 model. Were Americas Largest Mortgage Lender. With a general budget you want to.

Web The Bottom Line. Principal interest taxes and insurance. Apply Now With Quicken Loans.

Web 25 Post-Tax Model. Find A Lender That Offers Great Service. Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more.

Web Following Kaplans 25 percent rule a more reasonable housing budget would be 1400 per month. Scroll down the page for. Compare More Than Just Rates.

And they see a 28 DTI as an excellent one. Lock Your Mortgage Rate Today. Web As mentioned above the rule of thumb is that you can typically afford a mortgage two to 25 times your yearly wage.

Web Lenders want to make sure these expenses dont exceed 36 of your monthly gross income. Apply Get Pre-Qualified in 3 Minutes. Web So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000.

Keep your total debt payments at or below 40 of your pretax. Veterans Use This Powerful VA Loan Benefit For Your Next Home. But with a bi-weekly.

Web 14 hours agoMortgage rates increased this week. Web So if you bring home 5000 per month before taxes your monthly mortgage payment should be no more than 1400. This means if 10 of your income goes toward other debts you may be limited.

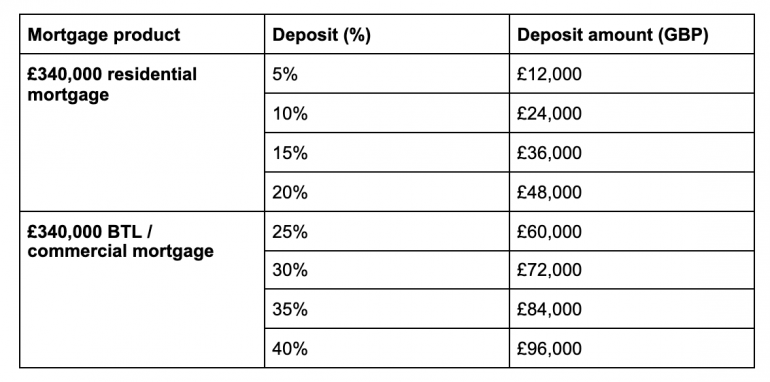

340 000 Mortgages Affordability Eligibility Requirements

How Much Mortgage Can I Afford Tips For Getting Approved For The Largest Loan Possible Investor S Business Daily

The Percentage Of Income Rule For Mortgages Rocket Money

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

What Percentage Of Income Should Go To Mortgage Morty

Mortgage Income Calculator Nerdwallet

How Much House Can You Afford Readynest

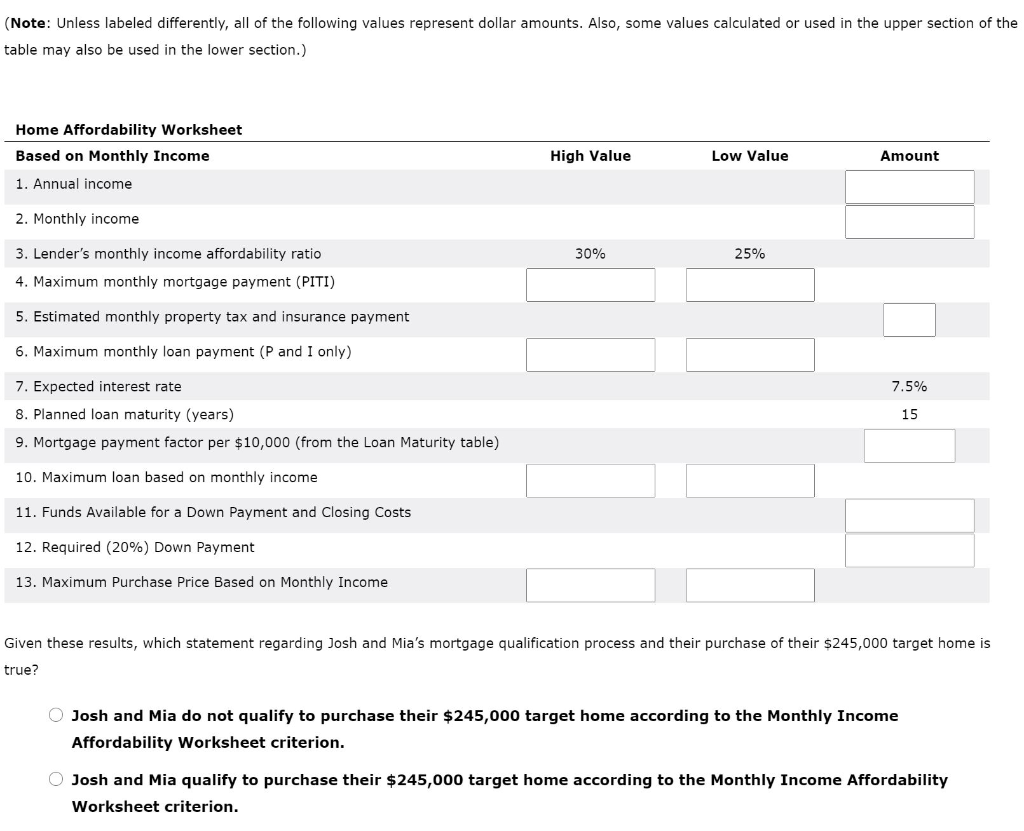

Solved Can Josh And Mia Afford This Home Using The Monthly Chegg Com

What Percentage Of Your Income Should Go To Your Mortgage Hometap

This Chart Shows How Much Money You Should Spend On A Home Mortgage Help Best Mortgage Lenders Interest Only Mortgage

Income To Mortgage Ratio What Should Yours Be Moneyunder30

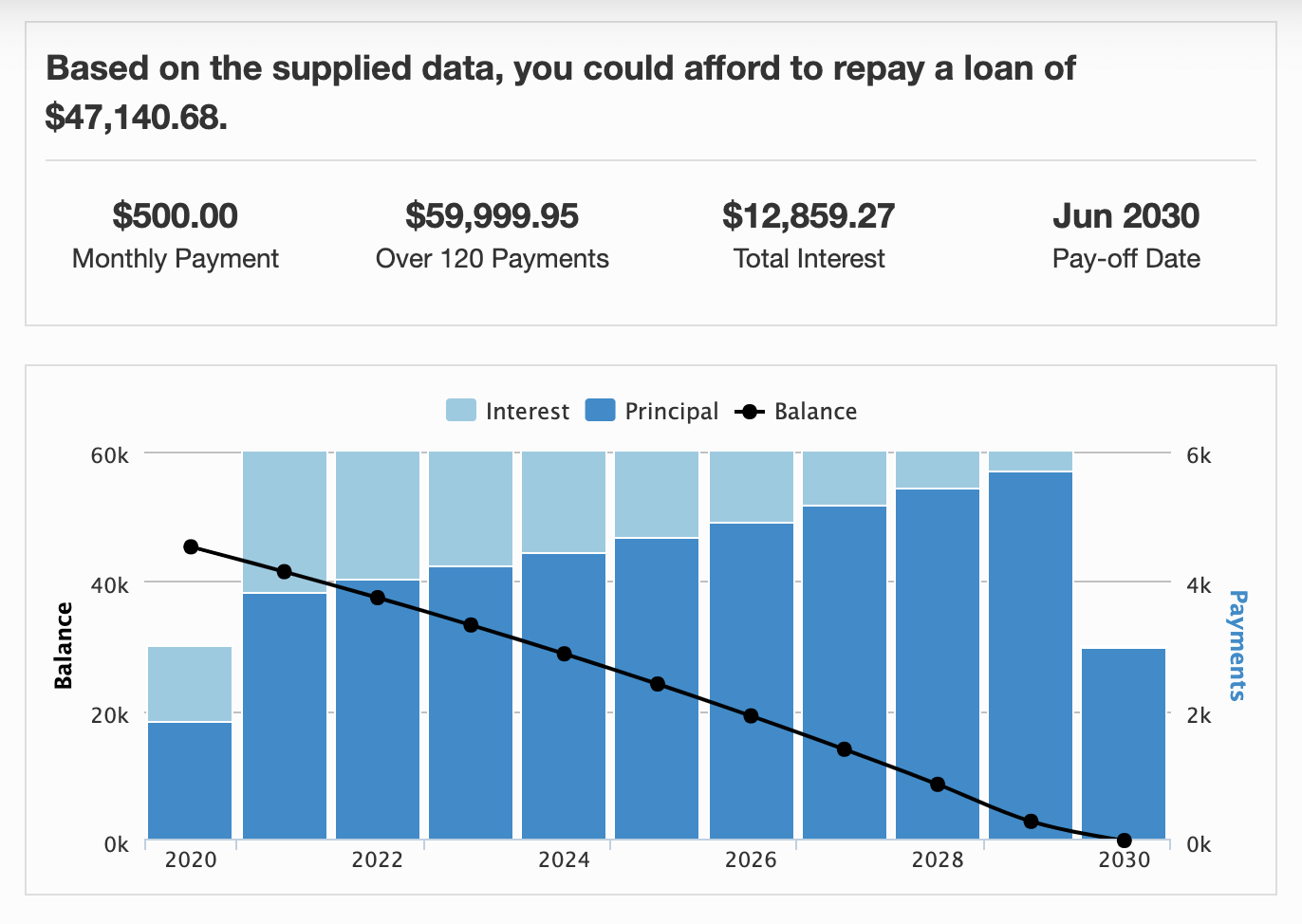

Loan Affordability Calculator Crown Org

What Percentage Of Your Income To Spend On A Mortgage

The Jobs Report In Light Of What Powell Said The Fed Cannot Create Supply Of Labor But It Can Slow The Demand For Labor Wolf Street

How Much Home Can You Afford Advanced Topics

Improving Public Sector Service Delivery A Developing Economy Experience Emerald Insight

How Much To Spend On A Mortgage Based On Salary Experian